Trade Recap (Feb-Apr 2020): $MNLO, $MCEP, $WWR, $AMRN, $BCRX, $ALDX, QTNT

So here’s what happened since my last blog post. Coronavirus and COVID-19 have become household names, $SPY melted from a high of 335 level on Feb 19 to lows of 218 on Mar 23 - that is a drop of 35.8% in just about a month’s time. Oil futures went negative just this past week. Drop in major indices and big caps brought a lot of volatility and depressed valuations to small caps. This in turn created a lot of opportunities for entering and adding to value swing positions.

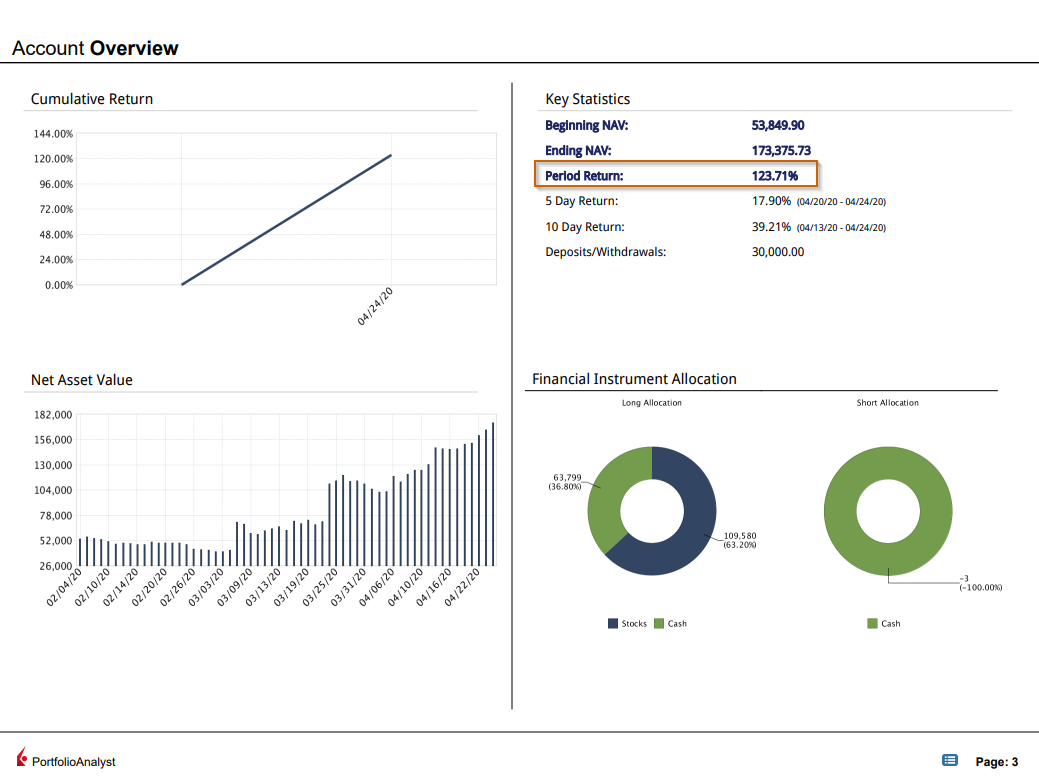

To take advantage of the situation, I added an additional $30K in funds to this account. I am considering this as a loan to the account and will take a distribution back out to myself at some point.

7/17 Update: Took out $32K in distribution to myself so this cancels out the $30K in funds that I had loaned out to my IB account.

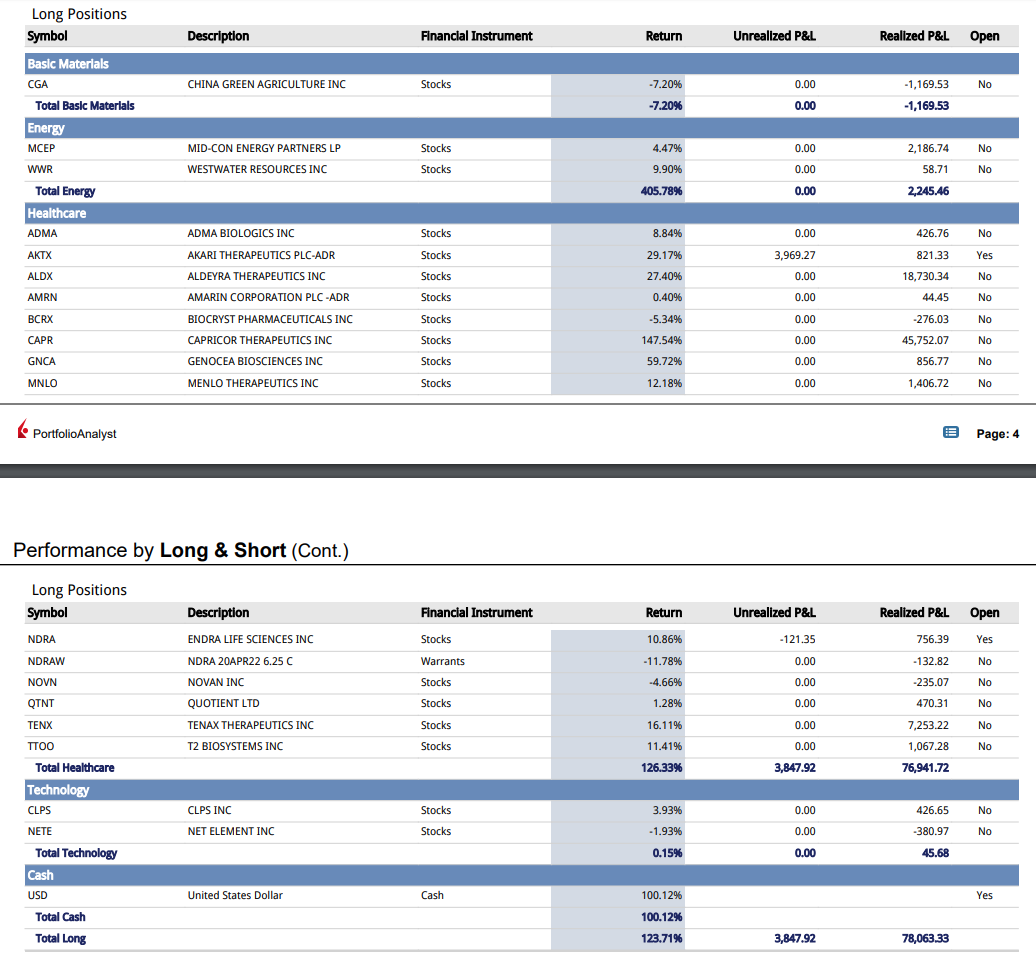

With this in context, let me get to the trade recap from the last couple of months. I executed several trades - most of them worked and some didn’t. I also did a few very short term swings and day trades which is not my usual style. In summary, I’ve got too many trades to recap here in retrospective but in the spirit of full transparency on this account and the blog, I will post below all the trades from my last blog entry to date.

$CAPR was a monster swing and think this one has still some juice to go so will look for additional opportunities to trade this ticker. $ALDX was a nice gainer too. Pretty solid returns overall on the account and I am pleased with the ramp.

Currently holding swings on $AKTX, $NDRA and about 33% of NAV in cash for new opportunities.